LEGALLY FIRE THE IRS FROM YOUR RETIREMENT ACCOUNTS

Learn The Strategy To Roth Convert Your IRA Without Using Your Principal To Pay The Taxes!

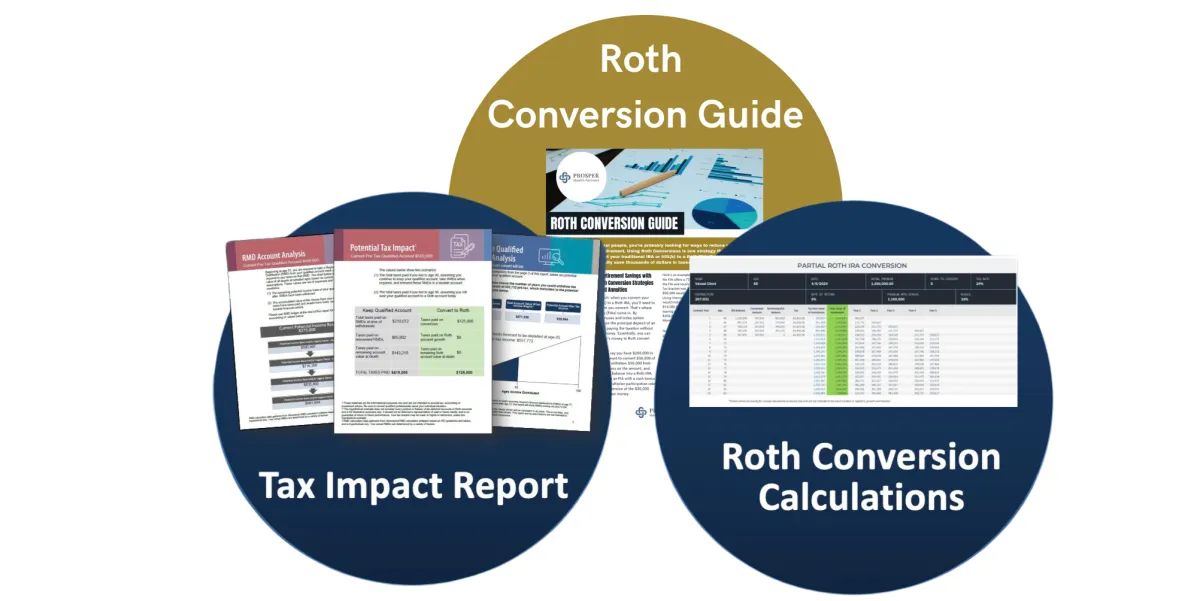

Get Your Complementary Roth Conversion Success Kit

Roth Conversion Guide + Tax Impact Report + Roth Conversion Optimizer

* Fill out the survey, then

* Watch the video on the next page

* Set an appointment to see if you qualify

Do you want to pay less taxes in retirement?

We can HELP!

Answer👇 5 Quick Questions Below & Get Your

FREE Roth Conversion Guide & Success Kit

🚀 Supercharge Your IRA / 401k with Tax-Free Growth! 🌟

Benefits of a Roth Conversion

Taxes Are On The Rise

Today we are at the lowest tax rates we are likely to ever see again. Inflation, rising interest rates, and a 34-trillion dollar national debt all mean one thing:

Taxes have to go up!

Eliminate RMDs

Required Minimum Distributions are specifically designed to drain your entire retirement nest egg during your lifetime and accelerate the distributions in the early years of your retirement.

Convert To A Roth IRA

The reason some people do not convert to a Roth IRA is that they don't want to pay the taxes. We solved that problem for you with this strategy!

You no longer have to use your own money to pay the taxes on your Roth Conversion.

Next Steps

Qualify With Our

1- Minute Survey

Watch the short video afterwards explaining this highly effective tax saving strategy.

Speak With a Roth Conversion Specialist

Get your own custom conversion example after a 15-minute discovery call.

Enjoy Financial Security In Retirement

RMD Avoidance, Tax-Free Growth & Income in Retirement.

Victor - North Carolina

John guided me through the process of doing a Roth Conversion without using my principal to pay the taxes. I needed this money safe and secure and tax free and we are on our way to doing just that!

Nancy - Arizona

I was working with a big bank and I wasn't sure if what I was doing was putting me in the best position for retirement. We did a full comprehensive plan and found ways to optimize my portfolio and reduce my future RMDs. This was the advice I had been searching for.

Jake - Florida

I wanted to minimize my RMDs and pass money down to my kids without them paying an absurd amount in taxes. We created a plan to strategically move the money into tax free buckets over the next several years and the money can grow tax free forever. 10/10 advice.

Andrew - New Jersey

The Tax Impact report was eye opening. I had too much in my IRA and RMDs were coming fast. I now have a strategy to cut my taxes and leave tax free money to my kids and grandkids. I wish my advisor told me about thisyears ago.